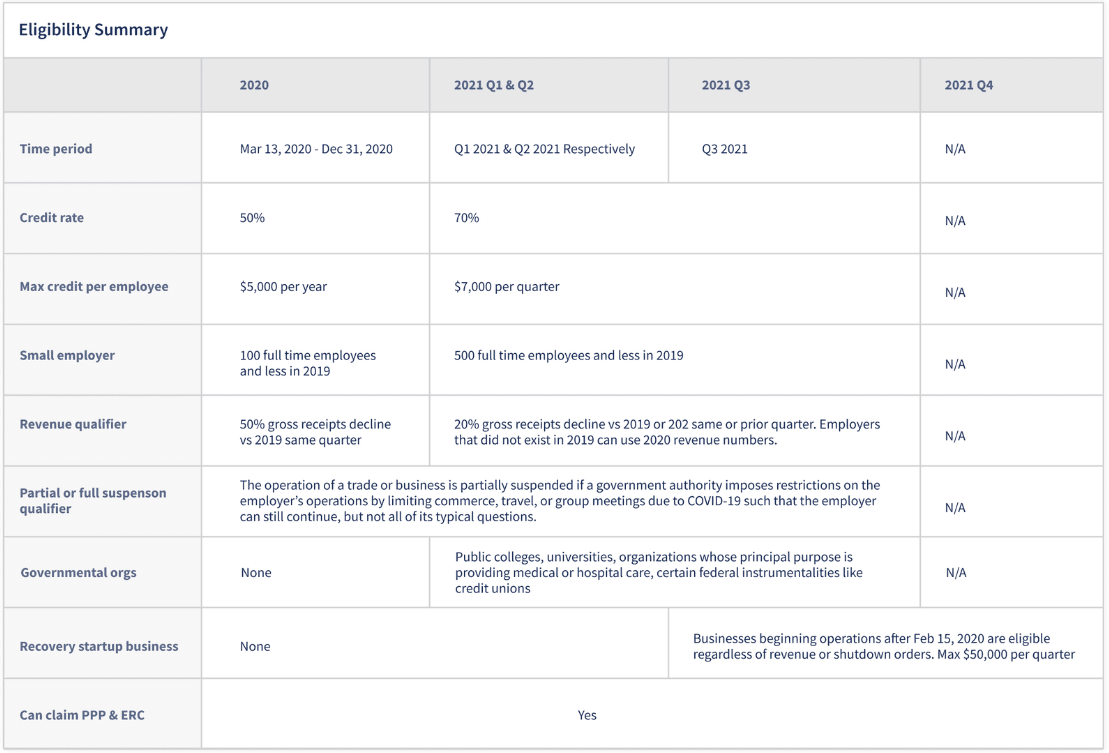

Can I get ERC Funds if I already took the PPP?

Yes. The Taxpayer Certainty and Disaster Tax Relief Act of 2020, enacted December 27, 2020, modified the ERC credit rules. One of the modifications included allowing a company to have a PPP loan and still take advantage of the ERC credit. However, you can't use the same dollar for dollar funds. We take this into account when processing your ERC credit.